It will take 16 weeks for them to be processed.Īmended federal returns are not electronically submitted. The tax returns for the federal and state should be sent certified mail. Changes to filing status would be addressed in the My Info section after triggering the amendment. Your filing status of single is not changed.

TURBOTAX 1040X AMENDMENT FULL

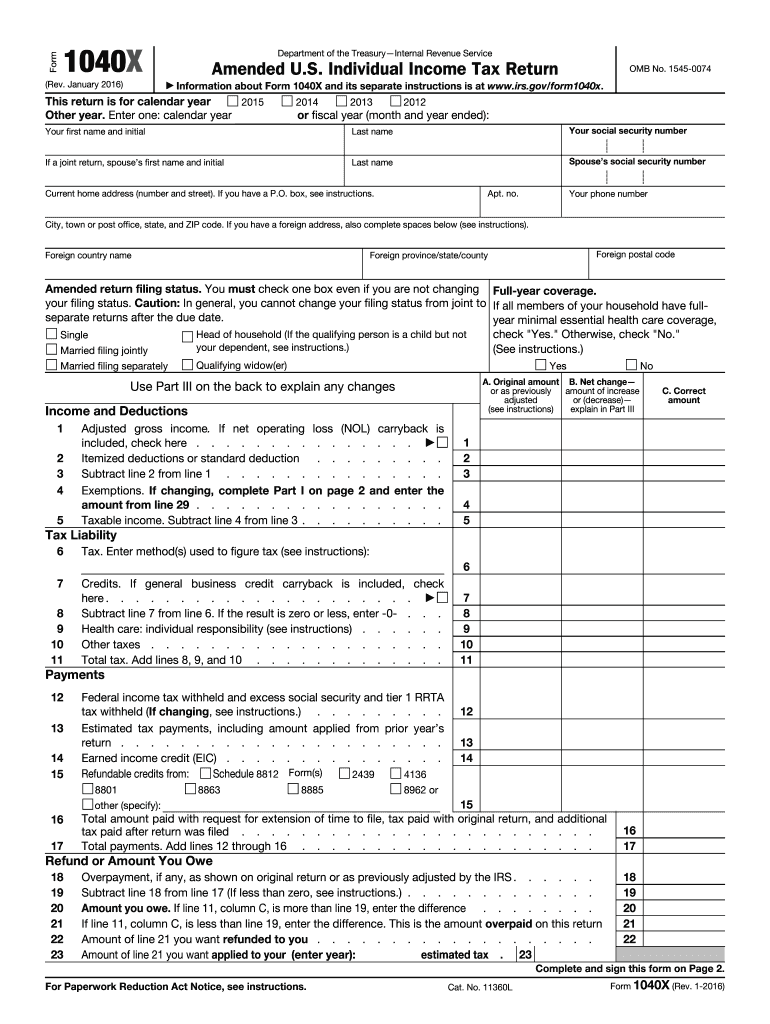

Form 1040-X with line 2 changed to the full amount of the standard deduction, $12,200, for singles.

TURBOTAX 1040X AMENDMENT HOW TO

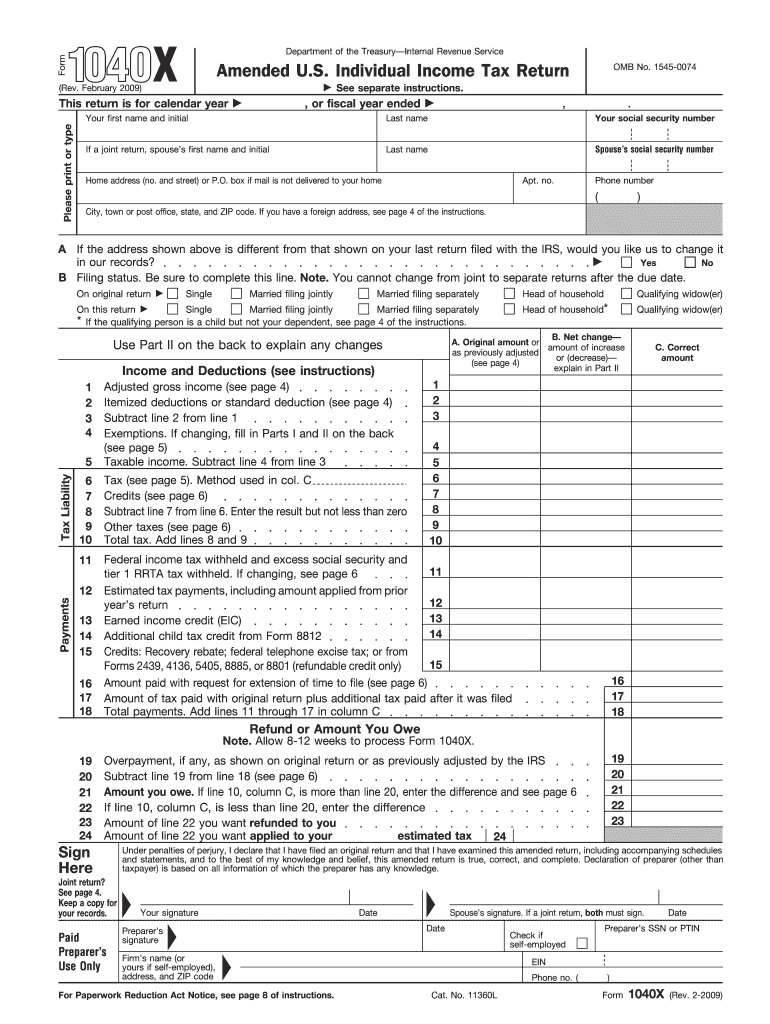

Click the link for instructions: How to amend (change or correct) a return you already filed. If you do qualify to be independent, then before anything is changed in your return, trigger the amendment. Next, check 2019 Publication 501 Dependents, Standard Deduction, and Filing Information on page 4 and page 11 to determine if you are or are not qualified to be a dependent. There is a note on Form 1040-X page 2: For amended 2018 or later returns only, leave lines 24, 28, and 29 blank. The exemptions and dependents section is no longer applicable because there are no personal exemptions any longer. Keep in mind that since you live in Massachusetts, you will need to amend your state income tax return as well.It depends. First, check the instructions linked below for Form 1040-X. If you wait for a notice to be issued, it can result in substantial penalties and interest being assessed in addition to the taxes due. Generally, the omission of income reported on Schedule K-1 from your return will generate an IRS notice regarding the missing income if it is substantial enough to generate a tax liability. A larger liability would require you to amend. If the amendment shows little or no tax due (under $100), you generally do not need to file the amended return. You will want to “run the numbers” to determine the effect the additional information will have on your taxes. It is also possible that the K-1 items may generate a refund for you. If the income items on the Schedule K-1 are sufficiently large, they will generate additional taxes due on your individual return, which will require you to amend the return. If the deceased owned rental properties or a business, the K-1 will also report your share of the income from those activities.

TURBOTAX 1040X AMENDMENT PLUS

If they had substantial investments, the K-1 will report your share of interest, dividends, and capital gains, plus any associated deductions. This can be a broad range of income depending on the assets of the deceased person. A Schedule K-1 is a reporting form which will report to you the items of income generated by the estate which are normally distributed to the beneficiaries. Since this is an inheritance, an estate return would need to be filed first.Īs for whether you need to amend your return, it will depend on what is on the Schedule K-1. The entities that generate these forms are generally on the same calendar year as you are, so they need time to prepare the returns and get the forms to the beneficiaries. We are assuming you meant that you filed your 2020 federal tax return in February 2021, and that you are waiting for the new Schedule K-1 to arrive for your inheritance.įirst, it’s not unusual for income that is reported on Schedule K-1 to get reported to you later than other tax forms. Do I need to file an amended tax return when that form arrives? 15 and says something about keeping 10% to pay 2020 taxes. I then learned that a K-1 form for a small inheritance will not arrive until Mar.

0 kommentar(er)

0 kommentar(er)